It is no different to the idea that a doctor needs to see his patient, but may find looking at a chart of food-intake or white-blood-cell counts or whatever informative.

So any "dilemma" between Virtual Energy Surveys and "Boots on the ground" surveys is a false dilemma. Both have value, both have shortfalls, and in fact they complement one another very well.

So where does this leave the FM?

Very often facility managers provide an on-site presence (sometimes many staff with varying skills and levels of specialisation). They also very often have "central" reporting and contract support functions. This infrastructure implies that their business models are ideally suited to the coming wave of "Virtual Energy Services".

I'll turn back to that thought in a minute but first let's ask what is "virtual" about a "virtual energy service"? - after a few seconds thought it becomes apparent that it is a silly misnomer. The doctor reading a chart is not "virtually" considering your high temperature, he or she is merely considering the data in a format of a chart, rather than looking directly at a thermometer. The "virtual" advantage is that the data represents a history, rather than an instantaneous glimpse.

So a "virtual energy survey" can be conducted anywhere. If being remote from the source of data is advantageous for a particular business model then great - or if the expertise is on-site - better yet!

By contrast inspection generally needs to be conducted in-situ - yes cameras and so on can be an expensive second best (but if you are surveying in a harsh environment may be a necessity).

So, turning back to the FM if we assume, localised staffing for some routine functions, and analytic support from the centre for diagnosis and interpretation is a general model, we find it matches exactly to the ideal business model for Energy Performance Contracting (EPC) and Energy Services (or Savings) Companies (ESCO's).

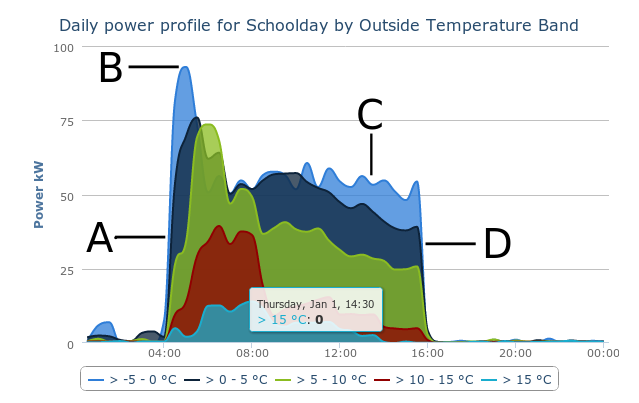

There is however something more interesting. Many very large FM have own in-house IT departments, (who are more than capable of putting some data into a chart). However, very few have the domain specific capabilities of pattern-recognition and diagnosis of for example HVAC plant activity.

Pattern Recgnition

A - Optimum Start Failure

B - Excessive Boiler Boost

C - Low Load dry-cycling

D - No Optimum Off

The mid-size FM Advantage

This leads to a natural marketplace for the medium and smaller specialist FM. The ones that "get" energy savings. If a product were available that surpassed the capabilities of the big FM solution, but required more "added-value" in the implementation of improvements, there would be the opening of a new and "disruptive" business model.

We are seeing some signs of this. Our natural fit with EPC's and ESCO's continues, but often there is a need to co-ordinate remote diagnosis with "boot on the ground" implementation teams. The more enlightened and agile FM companies (that typically do not have in-house diagnostic capabilities) are seeing the scope for natural partnerships.

Market changes in Facility Management

So where two decades ago we saw consolidation of big FM cleaning and security services within international partnerships to support multi-nationals, now we are seeing interest from more specialised controls, and plant maintenance services in forming alliances with FM diagnostic support functions.

It will be interesting to see if the marketplace sees a flurry of acquisitions, or whether more informal complementary partnerships will emerge - one often leads to another!

For our part, in so far as kWIQly capabilities enable these broader, competitive business models, we are delighted to play our part.